Mark and Livy are approaching their 70’s and looking ahead to their retirement years. They talk with their financial advisor about how to best balance their objectives:

- Ensure sufficient access to future income when needed, but at lowest tax cost possible.

- Leave an appropriate amount for individual heirs.

- Continue giving to their favorite charities both now and in the future.

They learn that their $1.5million 401k account will obligate the taxable withdrawal of up to $1.3 million in RMD within their first 15 years of retirement.

Mark and Livy will choose an approach that they feel works best for them. Your approach may differ from theirs, but it can be significant all the same.

They also realize that QCD’s can only be made from IRA accounts, and can only offset RMD from IRA’s.

After reviewing various options with their tax advisor, they are able to decide on how much income they may need from the 401k, and decide to roll over an appropriate percentage of that 401k to a separate traditional IRA account.

The dedicated IRA account will be used to make QCD’s to offset up to $100,000 each year of RMD associated with that IRA account.

With two separate retirement accounts, they will now be able to use one account to make beneficiary designations to the individual heirs and the other to make their charitable arrangements.

Knowing that these plans can be easily changed, they plan to work with their advisor to establish a trust document for a Charitable Remainder Unitrust (CRUT) which can be either initiated upon death (Testamentary) or funded during their lifetimes and supplemented by designation from either retirement plan account upon their passing.

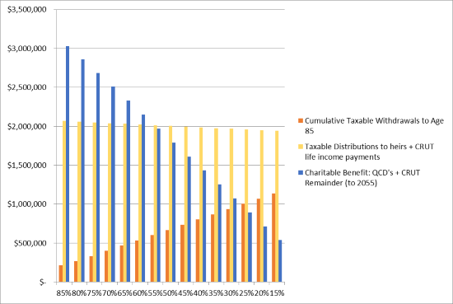

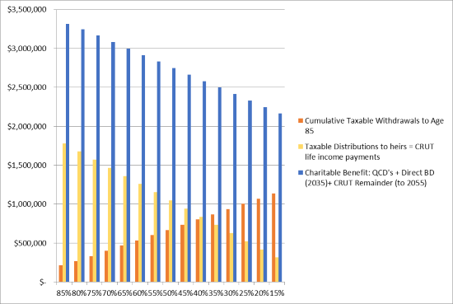

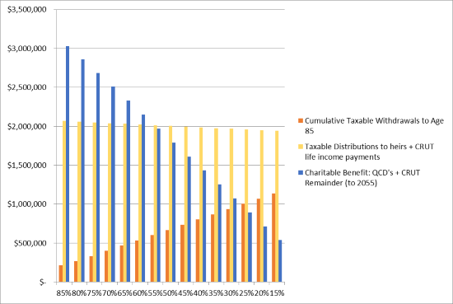

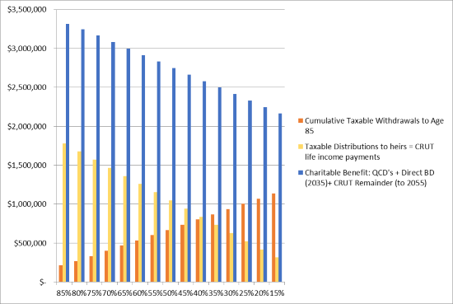

Here are just two of the possibilities they have considered: (In each scenario below, any percentage split from the main account to an IRA will result in differing combinations of taxable withdrawals, taxable distributions to heirs, and charitable benefits.)

|

QCD’s, Designation to CRUT for heirs and

Designation to Individual heirs

|

QCD’s, Designation to CRUT for heirs and

Designation to Charity

|